You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Market 2022-2023-2024

- Thread starter Folster

- Start date

- Joined

- May 14, 2002

- Posts

- 84,429

- Reaction score

- 33,088

There seems to be no deviation from the course that the Fed has already outlined.

And the markets liked it and then suddenly they didn't and now we're all red.

Holy canoly. There are those thousand point swing....damn.And the markets liked it and then suddenly they didn't and now we're all red.

Folster

ASFN Icon

- Joined

- Jun 23, 2005

- Posts

- 15,947

- Reaction score

- 6,145

It's always the Q&A that does it.Holy canoly. There are those thousand point swing....damn.

Cranking out overtime to get my house on the market before February is over

Good luck man!Cranking out overtime to get my house on the market before February is over

Folster

ASFN Icon

- Joined

- Jun 23, 2005

- Posts

- 15,947

- Reaction score

- 6,145

Snagged 5 more shares of TROW sub $156 on the pullback. I feel better now after going in too timid. Now I can sit back and wait and see what happens.

Boy I wish I had some cash to drop in with the drops. I start a new job on Monday and I'm "unemployed" this week so I have to be careful on my cashflow until the first check at my new job comes. It's also killing me that I don't got one more half pay period check coming from the old job still so I haven't been able to start the 401k rollover yet.

Folster

ASFN Icon

- Joined

- Jun 23, 2005

- Posts

- 15,947

- Reaction score

- 6,145

It's currently down 57% from it's high. That is rough. The tide definitely went out on that fund. And more pain is likely.Crazy to think ARKK was 160 in February of last year and could now be on its way to 40 this February...nutso

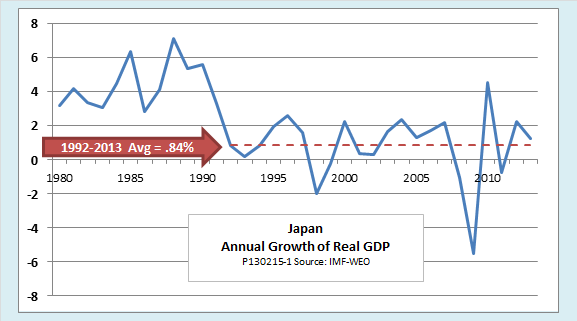

Growth And Quality Of Life: What Can We Learn From Japan?

There is a growing concern that economic growth, as we know it, is coming to an end. Economists, who tend to view growth as good, are uneasy with that idea.

Interesting read and interpretation on how deflationary and depressive conditions might not be so 'depressive' on the people in the long term....if this is in fact, where we are heading as a nation. Big if, but nonetheless intriguing.

Folster

ASFN Icon

- Joined

- Jun 23, 2005

- Posts

- 15,947

- Reaction score

- 6,145

For some perspective: The S&P 500 has only pulled back to October levels while the NASDAQ has pulled back to June levels.

82CardsGrad

7 x 70

10-year pops over 1.85.

This could be that spike before the collapse.. IMO. Either way, tomorrow should be chaotic.10-year pops over 1.85.

Scumbag day! Haha. Isn't that everyday for Cramer?xc_hide_links_from_guests_guests_error_hide_media

Never gets old

Folster

ASFN Icon

- Joined

- Jun 23, 2005

- Posts

- 15,947

- Reaction score

- 6,145

@elindholm INTC is getting rocked today, down over 6% based on earnings. I guess numbers were good but forward guidance is lower than expected. I want to buy more but I'm already at my portfolio max of 5% with them.

elindholm

edited for content

Part of my diversification strategy is to buy in for roughly the same amount with each holding. Trying to guess which bets I'm "more sure of" is too nuanced for me. If something goes up over time, it will gradually represent a larger percentage, but I let the market take care of that. So any individual stock, including INTC, is a small percentage of the pie.

That said, I took advantage of the dip today to buy AMAT, which is at a three-month low.

The one that's killing me right now is geothermal provider ORA, down 16% over the last five days. I like supporting green energy, but it sure does give some bumpy rides. It's a shame, because they were a strong performer last year.

That said, I took advantage of the dip today to buy AMAT, which is at a three-month low.

The one that's killing me right now is geothermal provider ORA, down 16% over the last five days. I like supporting green energy, but it sure does give some bumpy rides. It's a shame, because they were a strong performer last year.

- Joined

- May 14, 2002

- Posts

- 84,429

- Reaction score

- 33,088

Discovered today that my automatic RMD from my inherited IRA that was supposed to happen Jan 3rd didn't happen in Fidelity. I moved the fund from Vanguard to Fidelity and the initial move it accidentally went into an unmanaged fund, then we moved it to managed but apparently the RMD setup was on the unmanaged not the managed. I can't be bothered to do the math but I'm guessing the account was 4-5K higher on Jan 3rd than it is today but oh well. I don't use the money for living expenses I usually put it in a money market but this year I may buy stock with it.

Getting very interested in VICR where my GF works. It was at 164 and is now at 83, just beaten down due to the Nasdaq tank and the chip shortage. It's nothing wrong that they can control, they have plenty of demand they just need the chip shortage to ease up so they can ship product. The market as a whole opened well up on GDP news and then dropped to red, not really sure why but VICR was 90 when I first looked today. By the time my RMD money is in my account if VICR is under 80 will be tempting.

Getting very interested in VICR where my GF works. It was at 164 and is now at 83, just beaten down due to the Nasdaq tank and the chip shortage. It's nothing wrong that they can control, they have plenty of demand they just need the chip shortage to ease up so they can ship product. The market as a whole opened well up on GDP news and then dropped to red, not really sure why but VICR was 90 when I first looked today. By the time my RMD money is in my account if VICR is under 80 will be tempting.

The Buffett Indicator: Market Cap to GDP - Updated Chart | Longtermtrends

Market Cap to GDP is a long-term valuation indicator for stocks. It has become popular in recent years, thanks to Warren Buffett.

Haha. Perfect! There is no good explanation...it's all corrupt! That's why none of them....none...that can explain it to anyone with half a brain like Jon. Perpetual debt (fiat currency) is never meant to be paid off...it's meant to go to zero and wiped out. All anyone needs to do is look up fractional banking and they'll slowly start to understand our banking system and the federal reserve relationship. Ultimately, What does it all equate to...... Bankruptcy. Poof. Gone. Reset. We aren't there yet though.. I have zero clue what that will look like. Lolxc_hide_links_from_guests_guests_error_hide_media

You can find the full interview wherever you get your podcast.

Folster

ASFN Icon

- Joined

- Jun 23, 2005

- Posts

- 15,947

- Reaction score

- 6,145

I'm increasingly convinced that a market crash and recession is on the horizon. We've talked about all the fed nonsense and the easy money fueling speculation and huge asset bubble. But the biggest problem is the labor shortage and resulting inefficiencies. Anecdotally, we can't find enough people to answer the phones much less wait months for them to attain their licenses so they can do something besides basic service related issues. I'm seeing this everywhere from fast food to manual labor to white collar jobs. Employers can't innovate fast enough to make up for the labor shortage and meet the higher demand and AI is not ready for widespread implementation. A reset has to take place, something that causes some pain to reign in demand and cool things off.

All of the amateur real estate agents, crypto bros, and other speculators who have been coasting on the easy money asset bubble are going to get washed out and have to return to the workforce. Unfortunately the working class will also feel the pain like they do with any recession.

Despite my short term bear outlook, I am still bullish long term and look forward to more reasonably priced assets. If you are a millennial or a younger Gen Xer, a year or two of investing when the market isn't continuously hitting all time highs will do our retirement accounts some good in the long term.

I'm not recommending or even suggesting pulling your money out of the market and trying to time this thing. I am fully aware I could be 100% wrong. The only thing I've done in my retirement accounts is increase my exposure to international value and domestic value. I'm still 100% equity.

All of the amateur real estate agents, crypto bros, and other speculators who have been coasting on the easy money asset bubble are going to get washed out and have to return to the workforce. Unfortunately the working class will also feel the pain like they do with any recession.

Despite my short term bear outlook, I am still bullish long term and look forward to more reasonably priced assets. If you are a millennial or a younger Gen Xer, a year or two of investing when the market isn't continuously hitting all time highs will do our retirement accounts some good in the long term.

I'm not recommending or even suggesting pulling your money out of the market and trying to time this thing. I am fully aware I could be 100% wrong. The only thing I've done in my retirement accounts is increase my exposure to international value and domestic value. I'm still 100% equity.

Similar threads

- Replies

- 31

- Views

- 1K

- Replies

- 42

- Views

- 2K

Staff online

-

ajcardfanI see you.

-

Chris_SandersSuper Moderator

-

ShaneCurrent STAR

-

Dback JonKiller Snail

Members online

- ajcardfan

- KiwiCard

- myrondizzo

- AustrianCardFan

- Chris_Sanders

- Cards Crazy

- Rivercard

- shippy

- Ouchie-Z-Clown

- Tacticool Nerd

- Jrm477

- ProdigalSun

- Shane

- Gambler

- Hoodhero

- Red Bird

- BigRedArk

- Veer

- ellinikoscooby

- Cheesebeef

- gmabel830

- Proximo

- 602 Native

- AzCardzFan

- outcent13

- reebokalone2001

- Buckybird

- jasonmtcsn

- Camshaft

- AZCB34

- bg7brd

- MigratingOsprey

- Dback Jon

- Card4Life

- Phill11

- HairZach

- Clif2

- netsnjkidd

- CardLogic

- CardsFan88

- WakeForestCard

- bigskycard

- LudwigsMangina

- gimpy

- cardsfanmd

- Mr. Boldin

- Big D

- roland77

- Crimson Warrior

- NashDishesDimes

Total: 2,462 (members: 106, guests: 2,356)