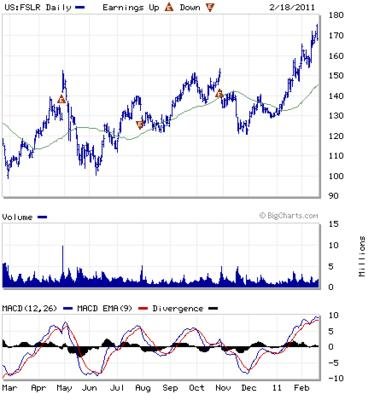

OK stock gurus, can somebody find me something wrong with this stock? This came up in P&R and I am thinking about it.

Great cash, debt/equity, current ratio, margin % and 300% sales growth over 2007 numbers with only a 16-17 P/E.

I need to research more and understand the analysts opinions which are all over the place.

Normally I don't like investing in individuals, but this one piqued my interest.

Shoot me down, folks!

Great cash, debt/equity, current ratio, margin % and 300% sales growth over 2007 numbers with only a 16-17 P/E.

I need to research more and understand the analysts opinions which are all over the place.

Normally I don't like investing in individuals, but this one piqued my interest.

Shoot me down, folks!

Last edited: