He may not be for everyone..but I like his style. He knows his macro IMO. He just released this today.

xc_hide_links_from_guests_guests_error_hide_media

I can’t get pass the horrible green screen

He may not be for everyone..but I like his style. He knows his macro IMO. He just released this today.

xc_hide_links_from_guests_guests_error_hide_media

I liked his old format of a wood paneling background better. lolI can’t get pass the horrible green screen

It’s tough because if there is a big drop that doesn’t rebound as quickly as March 2020 (itself very unusual) it will be very psychologically damaging. Others have been pushed by low interest rates into stocks, mortgages, and home equity loans. Stagflation would be a nice cherry on top. Even those who are diversified may be on shorter timelines.

I absolutely agree the lack of reciprocal cooperation on the debt ceiling is partisan economics of the worst kind. And while I think Trump’s personally motivated pressure on the Fed (and its capitulation) was so, so stupid, it was also a late-innings error in a game well underway.Exactly been having this debate online for weeks now the concern here is not just the debt limit the concern is because of Trump there is no safety net. Trump took interest rates down low when we were in a good economy, and then lower when Covid took the markets down. If the debt ceiling doesn't get suspended and the markets tank, it's MUCH harder to stop because we can't just open up a safety net they're gone thanks to Trump.

The whole thing is so incredibly bad 27.5% of the TOTAL debt today is from Donald Trump but the GOP is trying to take the economy and the markets down so they can blame it on Biden. From what I'm hearing now what really started today down was Yellen essentially saying if they don't up the debt ceiling it could be disastrous. And she's right.

I knew Trump was messing with Biden with the eviction moratorium he left that in place against GOP interest, and the extended unemployment because he knew Biden would have to end both and be the bad guy. But if those happen in the same month to 6 weeks the debt ceiling happens MILLIONS of Americans are going to get slammed financially all because the GOP is trying to make Biden fail.

I saw an article in Apple News from Forbes where they think the market is just now starting a correction.

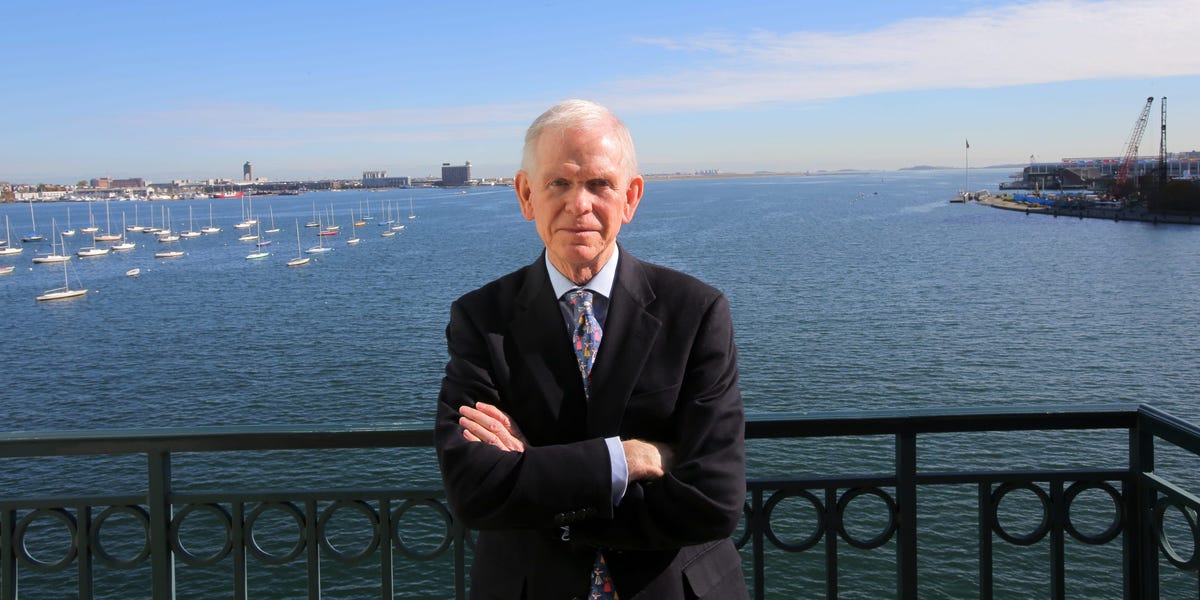

Legendary investor Jeremy Grantham says US stocks are in a crazier bubble than in 1929 – but this 'vampire' market is shrugging it off

Jeremy Grantham said stocks are in a huge bubble, but said "the end of a bubble is like a killing off a vampire."markets.businessinsider.com

The man has a good track record of signaling market tops....or being in the range of doing so.

Its always said that the mainstream never warns investors beforehand of these moves...very contrary to that belief, I've seen alot of warning from the media and major banks for this one. Whatever may come of it.. it's at least a step in a positive direction that we get retail investors more information that they can decipher from.I saw an article in Apple News from Forbes where they think the market is just now starting a correction.

I believe something big is coming....but how big is "big"… ? No idea. The Evergrande deal isn't great...but I think the whole debt market is extremely vulnerable right now. So it could only take one domino to set others in motion...ala GFCImpact of Evergaurd Group mess in China?

Some dude on Yahoo is saying we are 3 weeks out from the biggest collapse ever.

sounds like a yahooImpact of Evergrande Group mess in China?

Some dude on Yahoo is saying we are 3 weeks out from the biggest collapse ever.

Always a few at market tops..sounds like a yahoo

To be fair....covidxc_hide_links_from_guests_guests_error_hide_media

I think his point is to show how it just gradually keeps going up perpetually since the 70's.. Trump/Biden just kept it rolling. But yes, post-Covid really was the gas pedal to the ground.To be fair....covid

For sure. I saw the big spike at the end and was like oh yeah.I think his point is to show how it just gradually keeps going up perpetually since the 70's.. Trump/Biden just kept it rolling. But yes, post-Covid really was the gas pedal to the ground.

It's a great question. My answers always require a healthy dose of "conspiracy theory".For sure. I saw the big spike at the end and was like oh yeah.

There is a piece on Andrew yang about running for pres I read last night. About the physiologic toll, how you are the product to sell, not actually ceo, etc. Super interesting. President will never be the difference maker when the system is so well oiled and decided already.

Question?It's a great question. My answers always require a healthy dose of "conspiracy theory".

Thought experiment, then? It will remain a theory though because there will always be those who don't believe that the corps ultimately run the show... Imo, at least.Question?