So I bought into this last Nov after I heard they have optioned the "Hunger Games" film franchise. It appears they also now have rights to the final "Twilight" and all the residuals.

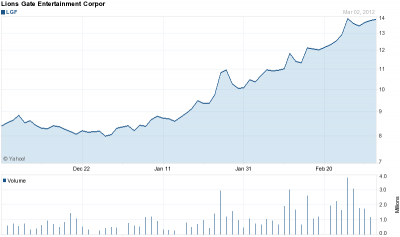

It's gone up 38% since I bought it and a nice Motley Fool snippet.

I just can't interpret Hollywood balance sheets/income statements as a lot of it seems to be funny money debt.

But if Hunger Games blows up this spring, maybe a bargain?

I normally don't buy stocks in industries I know crap about, but this was just a hunch.

You guys shot holes in my picks before, please tell me what I am missing here.

It's gone up 38% since I bought it and a nice Motley Fool snippet.

I just can't interpret Hollywood balance sheets/income statements as a lot of it seems to be funny money debt.

But if Hunger Games blows up this spring, maybe a bargain?

I normally don't buy stocks in industries I know crap about, but this was just a hunch.

You guys shot holes in my picks before, please tell me what I am missing here.