RALLY INTO RECESSION

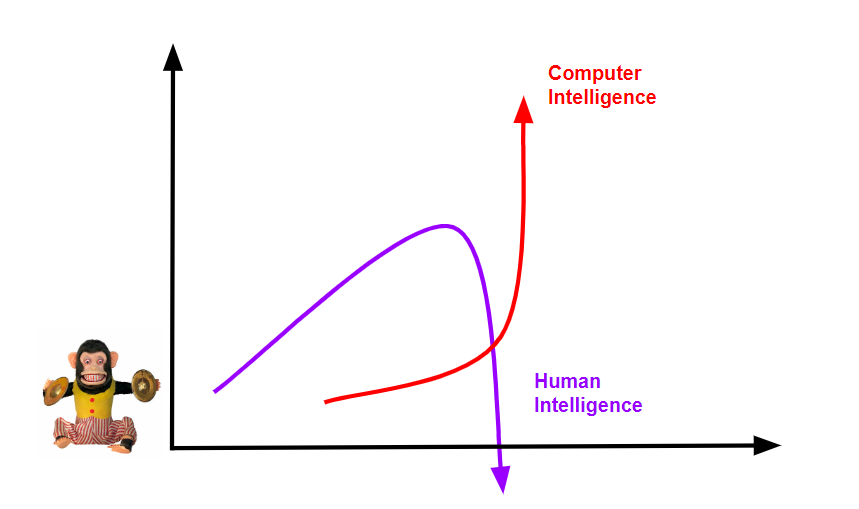

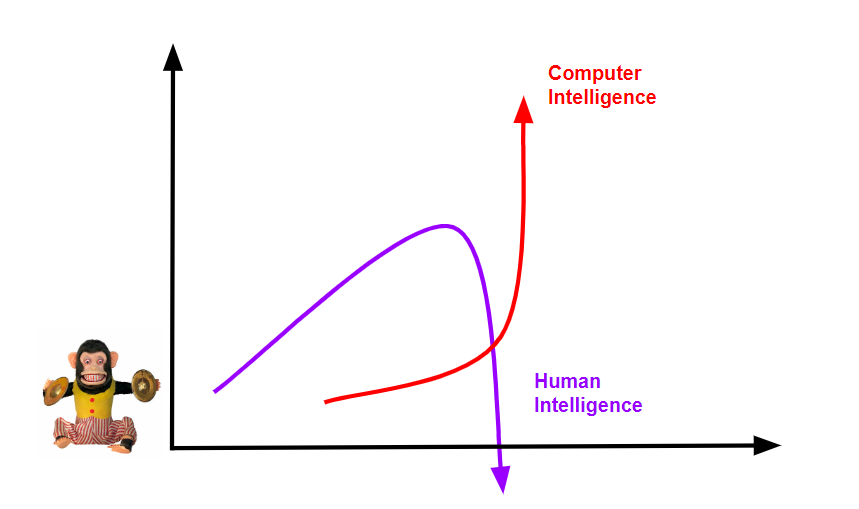

The entire bull case now hinges on recession and just-in-time bailout... We have now officially entered the age of Artificial Intelligence. ...

Do you have any evidence/information to disprove the silliness??People who still think a market bottom and recession are coming are silly. The market bottomed in October. People buying FUD nonsense from places like Zerohedge, convinced the world is about to crash and SP500 will be in the low 3,000's will miss out on all of the gains and cry about "manipulation". A tale as old as time.

Do you have any evidence/information to disprove the silliness??

Well, then you literally would be wrong if that's what you like to go off of... Bull markets are a series of higher highs and higher lows. The SPX hasn't met that criteria. Take out the highs from January of 22 and you'll literally be back on track.Yes, literally all of the evidence is on my side, including the most important data point, PRICE.

Well, then you literally would be wrong if that's what you like to go off of... Bull markets are a series of higher highs and higher lows. The SPX hasn't met that criteria. Take out the highs from January of 22 and you'll literally be back on track.

I was moreso curious to your silliness comment about thinking a recession is coming... It would literally be the first time in 25 years while having an (massively) inverted yield curve that we didn't. I guess we'll see if this times different.

These are all fair opinions. That's what I was originally curious about why you thought that..Nothing in the last 25 years can be compared to a once-per-century global pandemic that shut the world down, disrupted the supply chain in every single facet, the fiscal/monetary response, the pulled forward demand in certain areas and delayed demand in others, any of it. A totally unique set of circumstances that needs to be evaluated independently.

The inverted yield curve will naturally slow things down as will higher interest rates.

But we're 1 year into re-opening. Just getting started. Things are finding a new balance and absorbing the ripple effects of all of the above shockwave events. There will continue to be weird data points along the way.

Nothing in the last 25 years can be compared to a once-per-century global pandemic that shut the world down, disrupted the supply chain in every single facet, the fiscal/monetary response, the pulled forward demand in certain areas and delayed demand in others, any of it. A totally unique set of circumstances that needs to be evaluated independently.

The inverted yield curve will naturally slow things down as will higher interest rates.

But we're 1 year into re-opening. Just getting started. Things are finding a new balance and absorbing the ripple effects of all of the above shockwave events. There will continue to be weird data points along the way.

While I agree. It's kinda a double edged sword. To break out of control inflation you need to kinda break things.. this is an efficient way to do so. But the consequences of both can be pretty dire. If and when they overdo it, it can also cause runaway deflation. This is now a concern, and rightfully so imo.The only problem with quantitative tightening, is they always seem to way overshoot how much and how long to tighten.

I wouldn't be so confident one way or another. Despite its ups and downs, the market was flat in April overall. That tells me that the uncertainty is balanced on both sides.People who still think a market bottom and recession are coming are silly.

And the same can be said for Quantitative Easing... which the Fed completely screwed up by leaving it in place WAY TOO LONG and, IMNHO, became the largest contributor to the very inflation they are now trying to defeat!The only problem with quantitative tightening, is they always seem to way overshoot how much and how long to tighten.

Good question. I wish I had a better understanding of how precipitously things will fall apart once we cross the magic line into default. We're apparently using "extraordinary measures" to avoid being there already, but I don't know what that means.What are your guys' thoughts on how failing to increase the debt ceiling will affect the stock market?

Likely in a negative way if I was to guess....What are your guys' thoughts on how failing to increase the debt ceiling will affect the stock market?

We are at record levels in demand for our CDS (credit default swaps). This can make things a bit tricky if I was to imagine. We'll see, but it won't be pretty if it does happen. 2011 will be a nothing burger compared to this one..Yeah, I'm not sure what to do here. I'm guessing they'll get it worked out, but I wonder how much carnage will happen before they do.

I don't think either party has the balls to default on the debt when it comes down to it. The political fallout would be enormous. A deal will get done just as it always does. The issue will be used as a political football until all hands have been played.

I think short term the market would drop to this historic event. Long term, I think later on people will assume the US will pay its bills, albeit late. So the market will go back to normal.What are your guys' thoughts on how failing to increase the debt ceiling will affect the stock market?

Be careful with leveraged ETFs, especially if you don't use any technical analysis. Just my two cents.If I had more confidence I would totally put 10K in a 3x inverse ETF on the Dow waiting for a 10% or more fall as we get close to the cutoff. My assumption is we'll see a drop, and then the 2 sides will finally end it. If you could play it right you can get 30% profit on the way down, and probably more on the way up with a 3x ETF tracking the DOW. But if it goes opposite of what you think, you're going to lose most of your money.

Really tempting though. I'm just not sure I trust them.

Yes. Fear tactics, until then, can move the markets though. Will we actually default? Absolutely not. Not even a chance. IMO.I think short term the market would drop to this historic event. Long term, I think later on people will assume the US will pay its bills, albeit late. So the market will go back to normal.

If I had more confidence I would totally put 10K in a 3x inverse ETF on the Dow waiting for a 10% or more fall as we get close to the cutoff. My assumption is we'll see a drop, and then the 2 sides will finally end it. If you could play it right you can get 30% profit on the way down, and probably more on the way up with a 3x ETF tracking the DOW. But if it goes opposite of what you think, you're going to lose most of your money.

Really tempting though. I'm just not sure I trust them.

I love the idea of Biden trying to circumvent the entire debt ceiling business by using the Fourteenth Amendment. The whole debt ceiling charade is silly anyway. The debt is a problem, but it doesn't become less of a problem by creating arbitrary "limits" on it that have to be revised every year or two and don't, by themselves, do anything to influence behavior.